Data Science

Research Areas AI Quant

We analyze expenditure patterns,

tastes and preferences to offer financial

products tailored to each client.

Intro

The 21st century has been dubbed the “Century of data,” and the creation and utilization of vast amounts of data is in the spotlight. With the rapid development of AI technology, data science has become deeply integrated into daily life. The digital and mobile revolutions, including innovations like the smartphone, have all been made possible by advances in data science, and every industry, including finance, benefits. Today, both businesses and individuals alike generate profit by harnessing and trading data. This makes the ability to identify useful data amidst the vast diversity of information , extract important points, and develop new insights more important than ever. Finding the pearl (value) in the grains of sand (data) and polishing those pearls to a shine is the domain of data science.

What is

Data Science?

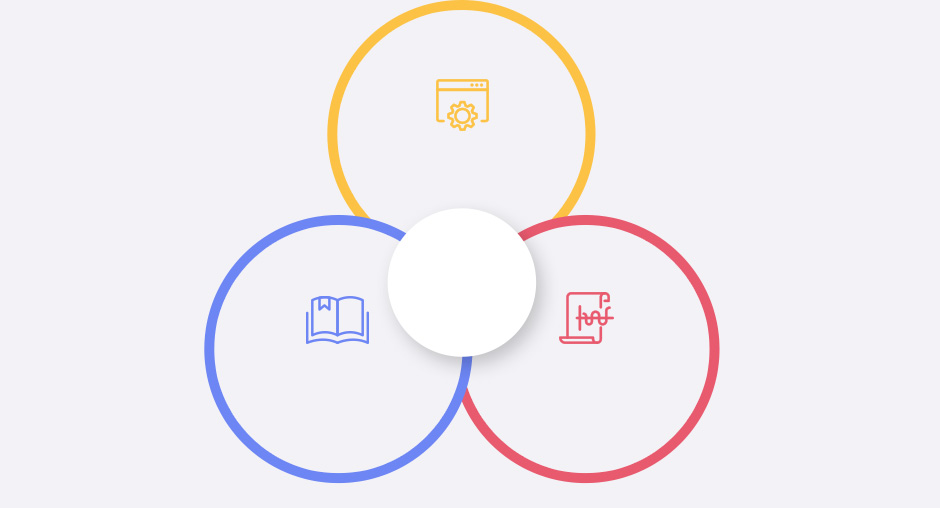

Data science can be explained as the intersection of three areas: computer science, math and statistics, and domain knowledge.

A data scientist is the person with these interdisciplinary abilities—well-informed in all three areas. A diverse range of knowledge and insight in multiple fields, followed by the ability to come up with creative ideas, is essential for those who work in data science

-

DATA

SCIENCE -

Computer

Science / IT -

Machine

Learning -

Domain / Business

Knowledge -

Traditional

Research -

Math and

Statistics -

Software

Development

HIT’s data science research aims to use our data to create innovative financial services. To achieve this, we utilize finance-related data of course, but we also use data from outside the financial sector. We strive to understand our customers from every aspect through their consumption patterns and preferences throughout all specific types of financial products. Data science allows HIT to provide new products and services that are the most suitable to each customer’s need.

DATA

SCIENCE

-

Feature

Extraction - Optimization

- Prediction

-

Recommen

-dation - Segmentation

1

Unsupervised

Learning

- Clustering

- · K-means Clustering

- · Hierarchical Clustering

- · Density Based Clustering

- Dimensionality Reduction

- · Non-negative Matrix Factorization

- · Principal Component Analysis

- · Linear Discriminant Analysis

- Association

- · Eclat Algorithm

- · Growth Algorithm

- · Apriori Algorithm

2

Supervised

Learning

- Classification

- · Support Vector Machine

- · Random Forest Classification

- · Decision Tree Classification

- Regression

- · Linear Regression

- · Ridge Regression

- · Random Forest Regression

3

Reinforcement

Learning

- · Trust Region Policy Optimization

- · Deep Q Network

- · Q-learning

Data analysis techniques grow increasingly sophisticated and complex every day. At HIT, we secure the latest technologies to increase our ability to provide innovative services, approaching problems with research techniques that have never been used before. To make this possible, we make good use of HFG’s collective intelligence—created by combining the knowledge of HIT data scientists and finance experts from both within and outside HFG.

Future Research

HIT aims to bring greater sophistication to HFG’s financial services through data science. To this end, HIT data science has prioritized three areas for enhancing these financial services: customer management, credit risk management, and work optimization. Our goal is to create comprehensive but personalized financial services that can serve as a future finance scenario, which can then predict what our customers will experience and span the full range of sectors in the financial industry: banking, securities, credit cards, and insurance. Customers can access personalized services, which will be provided permanently. In the future, finance will have evolved to the point that the products and services offered to customers will be what they want, in the desired format and at the desired time. Customer credit ratings and abnormal financial patterns are analyzed to establish an efficient management system that can minimize credit and operational risks, which in turn allows individuals and companies to prevent potential internal and/or external losses. We can also automate the simple and repetitive tasks in the financial sector to enhance work-related convenience. The manpower that consequently becomes available can then be re-directed to new tasks which add much higher value. The competitiveness of the future finance industry will rely almost entirely on increasing the value of customer experience. HIT is committed to tirelessly improving this value through data science research.